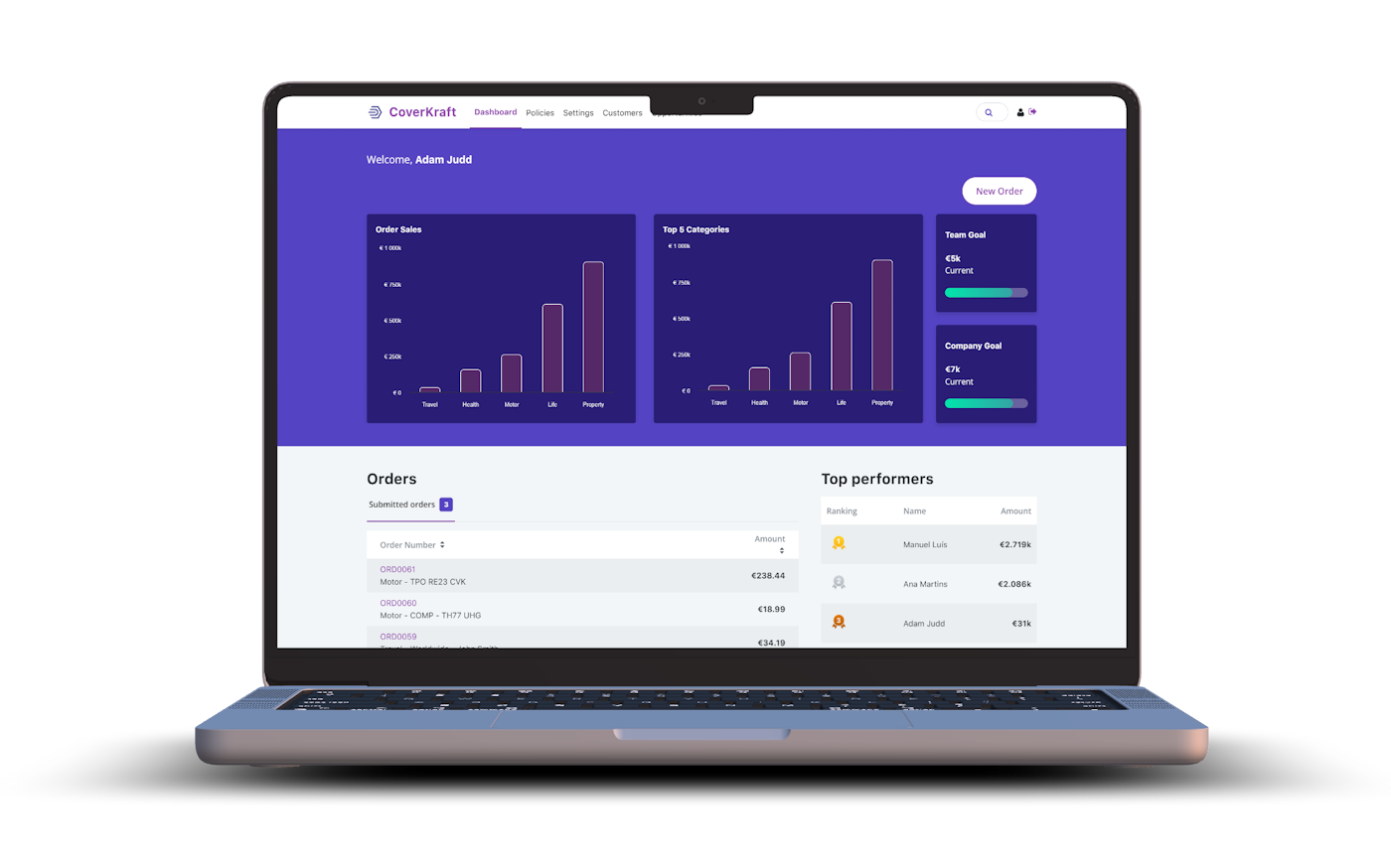

Launch online insurance products. Fast.

Rapidly scale your insurance operations with CoverKraft's highly customizable SaaS low-code platform.

TRUSTED BY

The online insurance solution

Insurance Software as a Service

-

Rapid Go-To-Market: Get to profit faster

-

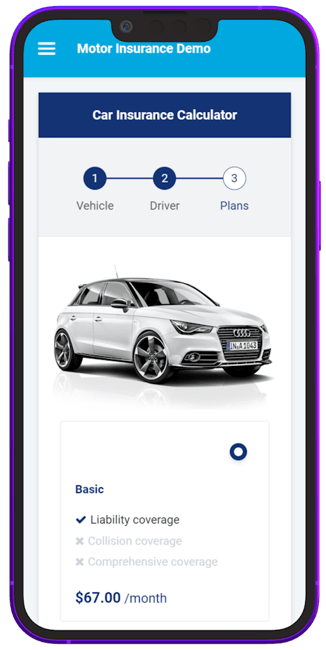

Reach New Channels: Connect via WhatsApp & more

-

Customizable Rating Engine: Stay Competitively Agile

The online insurance solution

Insurance Software as a Service

-

Fuel Innovation: Create disruptive products

-

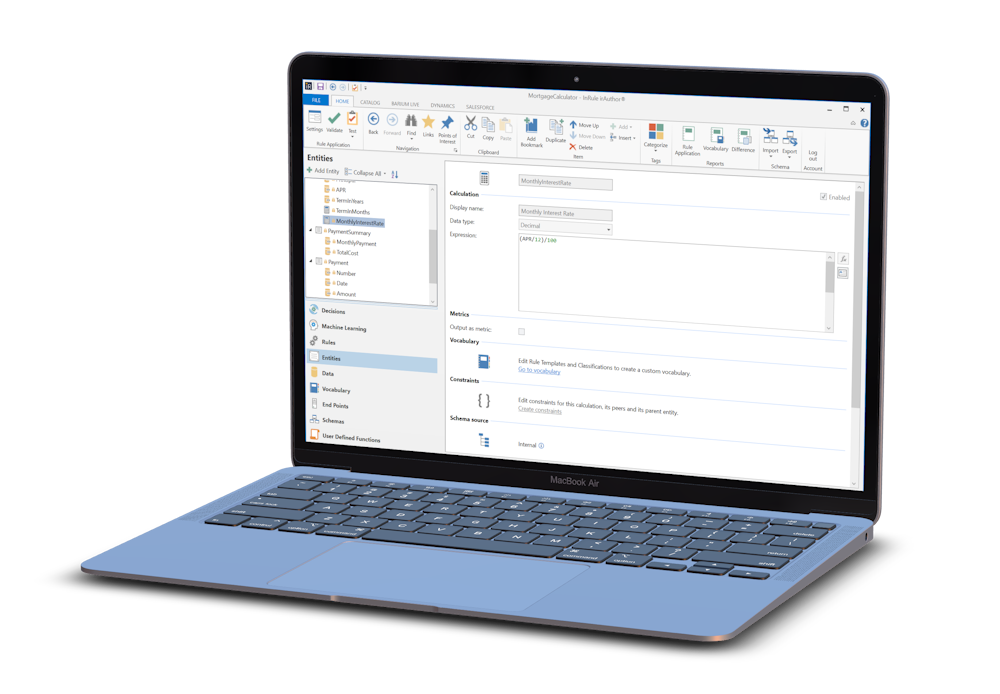

No-Code Configuration: Customize without Development

-

Seamless Marketing Integration: Full toolkit, including HubSpot

Simplifying Insurance:

No Code. No Limits.

Ensure reliability and substantial cost savings compared to traditional legacy policy administration systems

Build ANY INSURANCE product

Any Insurance Use-Case

CoverKraft is versatile and capable of seamlessly supporting a wide range of use cases and types of insurance, whether simple or complex, personal or commercial lines. Including but not limited to Motor, Health, Life, Travel and Property Insurance.

SPEED OF DEVELOPMENT

Faster Time to Market

No-code platforms allow insurance companies to launch new products and services quickly without extensive development work.

Latest Blog Posts

Insights, Trends, and Expertise: Empowering You with Insurance Knowledge.

I've been blown away by the ease of use and flexibility of CoverKraft's insurance platform - it's completely transformed the way we do business!